20 February 2015

The Auckland Energy Consumer Trust, the independent consumer trust and majority owner of infrastructure group Vector Limited, says Vector’s long-term diversified investment approach continues to benefit AECT beneficiaries.

Vector’s financial results for the half year to 31 December 2014 released today show prudent investments outside of its regulated energy networks have diluted the impact of significant regulator-imposed price reductions to its energy distribution infrastructure.

In the six months to 31 December 2014, investments in unregulated activities generated more than a quarter of Vector’s adjusted EBITDA, its key measure of financial performance.

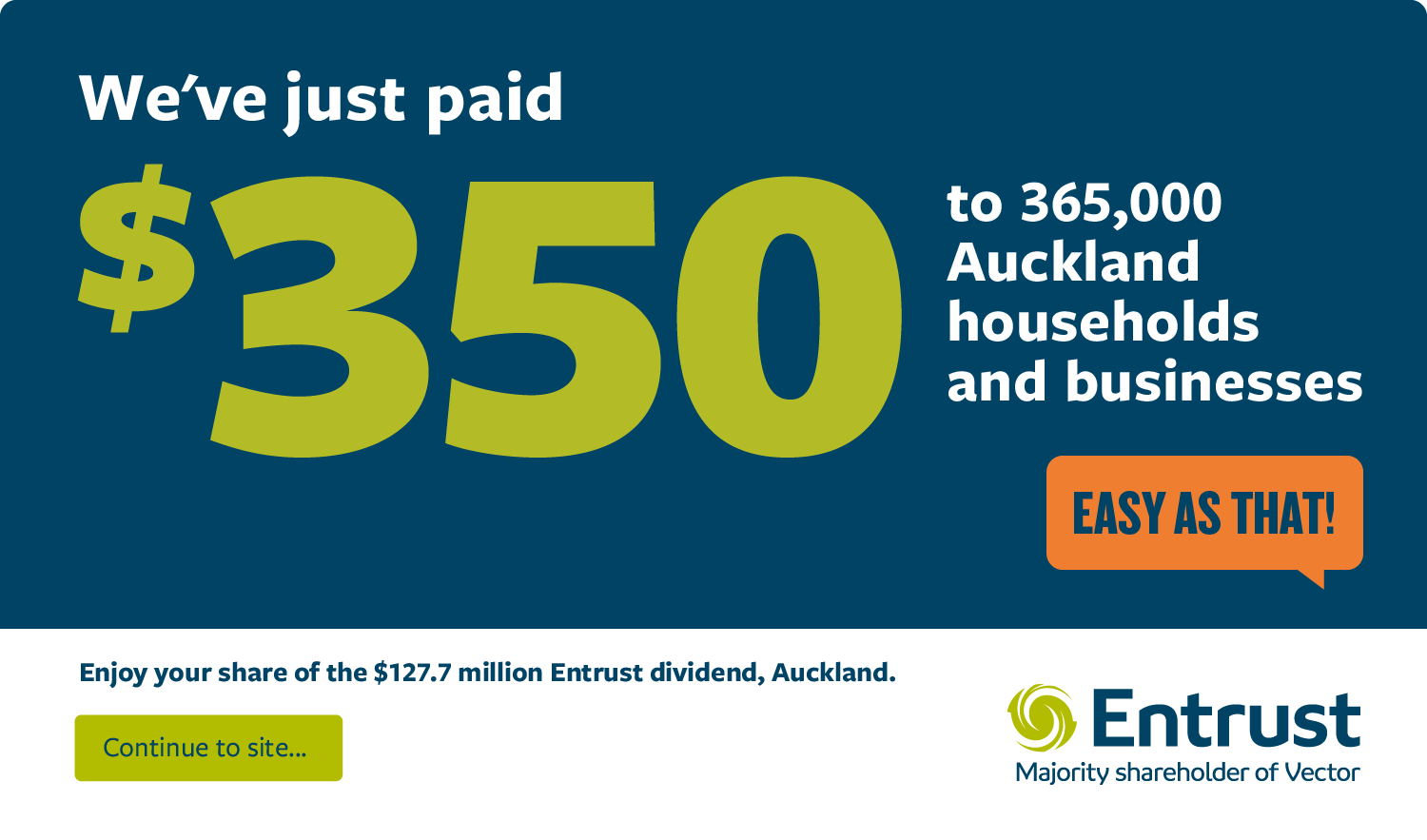

The unregulated investments also generated around a quarter of the $335 the AECT paid to beneficiaries in September 2014. Since the AECT was formed in 1993 it has paid out over $1 billion to beneficiaries.

Commenting on Vector’s half year result announcement released today, AECT Chairman, William Cairns says Vector’s nationwide investments in smart metering technologies; gas trading and telecommunications will contribute strongly to beneficiaries’ dividend in the long term as technology continues to change the energy industry.

“As Vector acknowledged today, the AECT’s willingness to look through economic cycles and allow Vector to invest for the long term in technologies such as smart metering is now delivering AECT beneficiaries handsome rewards,” said Mr Cairns.

Ends